#accounting

Accounting - questions and answers. If you have a question about this topic, please click on the "New Question" button. If you wouldn't like to miss any new question in this topic, please subscribe.

Habtamu Mengie

Habtamu Mengie

Habtamu Mengie

Habtamu Mengie

Anonymous

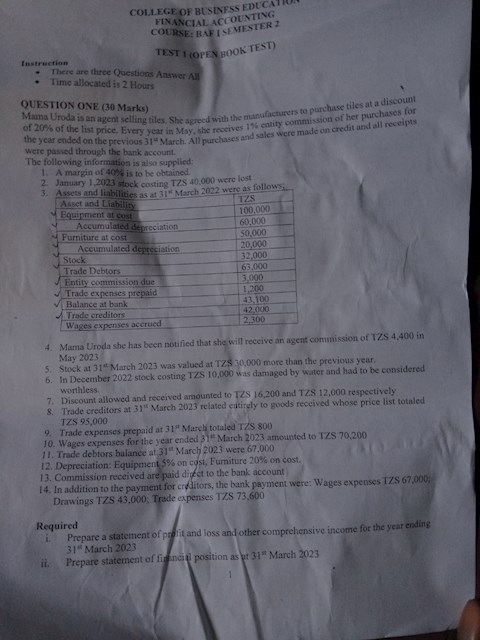

What is the answer for this accounting question ?

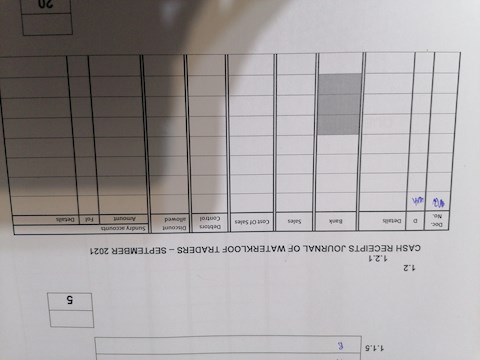

Answer using this 1.2 The transactions below appeared in the books of Waterkloof Traders for the month of September 2021. Waterkloof Traders uses 100% mark up at all times. INFORMATION: Transactions for September 2021: 01 The owner L. Wolvaardt, increased her capital contribution from R200 000 to R280 000 by depositing the amount directly into the business’ current account. Received a payment from K. Rabada in settlement of his account of R160, less 5% discount, issued receipt no.92. 03 Received a payment of R16 600 from FNB Bank Ltd for the fixed deposit of R16 000 which matured, plus interest. 04 Paid R2 380 via EFT to Gugu Wholesalers in full settlement of debt of R2 500. Cash sales for the day, R3 900. 05 T Bavuma’s debit order for R110 received last month in payment of his account, was returned by the bank unpaid due to insufficient funds. 06 Received an amount of R650 from K Maharaj as part-payment towards his account, the payment was done electronically. 10 Purchased goods from Elgar Dealers for R4 140, paid via EFT. Paid Courier Guy R300 for the delivery of the goods (mentioned above), via EFT. 20 Withdrew R870 at the ATM in favour of the municipality to pay the water and electricity account of the business. 22 Made electronic payment to ABSA Bank in part-payment of a loan, R7 000, plus interest on loan for R350. 27 Withdrew cash, R2 500 to pay wages R1 980 and used the rest to increase the cash float. 28 Cash sales of merchandise for the day, R1 520 including credit card sales of R520. 30 The bank statement received from FNB Bank showed that our bank account was debited with the following amounts: • Interest, R360 • Deposit book fees, R190 • Service fees, R210 • Tax levy, R164 REQUIRED: 1.2.1 Refer to the transactions above and record them in the Cash Journals for September 2021. NOTE: • Do not total the journals at the end of the month.

Ameria Nakalema

Chacha Samweli

Ameria Nakalema

mabunda risuna

Anonymous

Anonymous

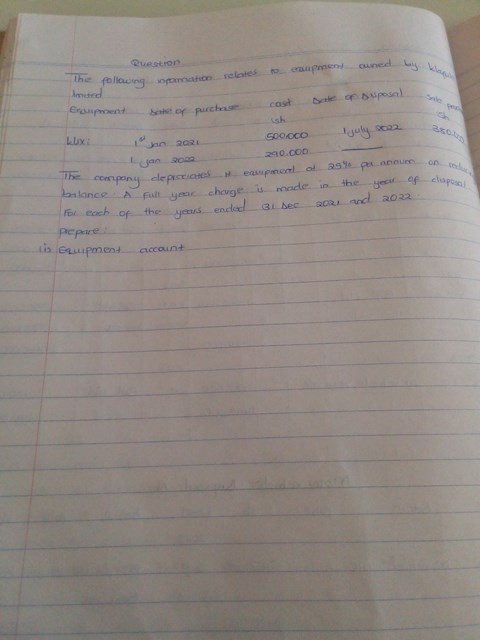

Financial accounting,, about disposal of multiple assets ??

Kindly help me,