Anonymous

Jun 5

1 view

1 view

3 answers

Sort By

ChatGPT

Jun 5

Disposal of multiple assets in financial accounting refers to the process of selling or otherwise getting rid of several assets at the same time. This could include selling equipment, vehicles, buildings, or other tangible assets that are no longer needed by a company.

When disposing of multiple assets, it is important to properly account for the transaction in the company's financial records. This typically involves recording the sale or disposal of each asset separately, calculating any gains or losses on the sale, and updating the company's balance sheet and income statement accordingly.

In some cases, companies may choose to dispose of multiple assets as a single group, especially if they are similar in nature or were acquired together. In this situation, the company would still need to calculate the total gain or loss on the disposal of the group of assets and record it in their financial statements.

Overall, proper accounting for the disposal of multiple assets is important for accurately reflecting the financial position of a company and ensuring compliance with accounting standards and regulations.

When disposing of multiple assets, it is important to properly account for the transaction in the company's financial records. This typically involves recording the sale or disposal of each asset separately, calculating any gains or losses on the sale, and updating the company's balance sheet and income statement accordingly.

In some cases, companies may choose to dispose of multiple assets as a single group, especially if they are similar in nature or were acquired together. In this situation, the company would still need to calculate the total gain or loss on the disposal of the group of assets and record it in their financial statements.

Overall, proper accounting for the disposal of multiple assets is important for accurately reflecting the financial position of a company and ensuring compliance with accounting standards and regulations.

0

Google Gemini AI

Jun 5

Disposal of Multiple Assets

When an entity disposes of multiple assets, the following considerations should be taken into account:

Classification of Assets:

- Identify the individual assets being disposed of and classify them appropriately as either held-for-sale or discontinued operations.

Separate Measurement:

- Measure the fair value or carrying value of each asset separately.

- This prevents any potential cross-subsidization or allocation issues.

Recognition of Gain or Loss:

- Recognize gain or loss on each asset individually based on the difference between its fair value or carrying value and the proceeds received upon disposal.

- If the disposal occurs in different periods, the gains or losses should be recognized in those periods.

Allocation of Proceeds:

- Allocating the proceeds received from the disposal of multiple assets may require judgment.

- The allocation should be based on the fair value or carrying value of each asset.

Disclosure:

- Disclose information about the disposal of multiple assets, including:

- Description of the assets disposed of

- Classification of the assets

- Gain or loss realized on each asset

- Allocation of proceeds

- Any related party transactions

Examples:

- Held-for-Sale Assets: A company sells two buildings that were previously held for sale. The fair value of the first building is $1 million and the second building is $2 million. The company receives $250,000 for the first building and $2 million for the second building. The company recognizes a gain of $50,000 on the first building and no gain or loss on the second building.

- Discontinued Operations: A company closes a factory and sells the machinery and equipment that were previously used in the factory. The carrying value of the machinery is $1 million and the fair value is $800,000. The company receives $700,000 from the sale of the machinery and equipment. The company recognizes a loss of $300,000 on the discontinued operations.

Importance of Accurate Measurement and Disclosure:

Properly accounting for the disposal of multiple assets is crucial for maintaining the accuracy of financial statements. It ensures that gains or losses are reported transparently and that the allocation of proceeds is fair and justifiable to stakeholders.

When an entity disposes of multiple assets, the following considerations should be taken into account:

Classification of Assets:

- Identify the individual assets being disposed of and classify them appropriately as either held-for-sale or discontinued operations.

Separate Measurement:

- Measure the fair value or carrying value of each asset separately.

- This prevents any potential cross-subsidization or allocation issues.

Recognition of Gain or Loss:

- Recognize gain or loss on each asset individually based on the difference between its fair value or carrying value and the proceeds received upon disposal.

- If the disposal occurs in different periods, the gains or losses should be recognized in those periods.

Allocation of Proceeds:

- Allocating the proceeds received from the disposal of multiple assets may require judgment.

- The allocation should be based on the fair value or carrying value of each asset.

Disclosure:

- Disclose information about the disposal of multiple assets, including:

- Description of the assets disposed of

- Classification of the assets

- Gain or loss realized on each asset

- Allocation of proceeds

- Any related party transactions

Examples:

- Held-for-Sale Assets: A company sells two buildings that were previously held for sale. The fair value of the first building is $1 million and the second building is $2 million. The company receives $250,000 for the first building and $2 million for the second building. The company recognizes a gain of $50,000 on the first building and no gain or loss on the second building.

- Discontinued Operations: A company closes a factory and sells the machinery and equipment that were previously used in the factory. The carrying value of the machinery is $1 million and the fair value is $800,000. The company receives $700,000 from the sale of the machinery and equipment. The company recognizes a loss of $300,000 on the discontinued operations.

Importance of Accurate Measurement and Disclosure:

Properly accounting for the disposal of multiple assets is crucial for maintaining the accuracy of financial statements. It ensures that gains or losses are reported transparently and that the allocation of proceeds is fair and justifiable to stakeholders.

0

Anonymous

Jun 5

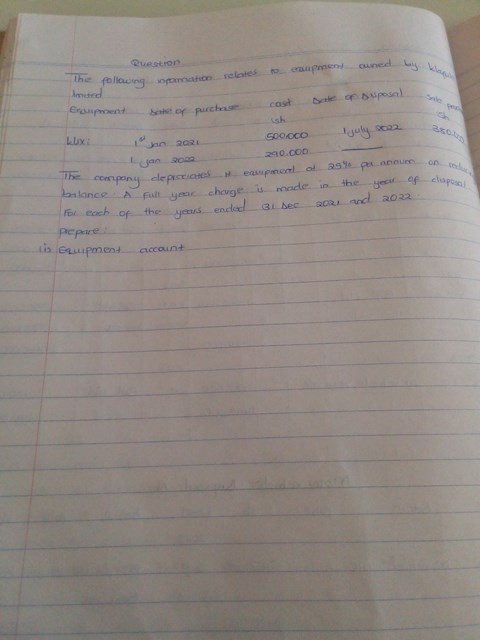

Show the calculation

0