neema omari

Nov 24, 2023

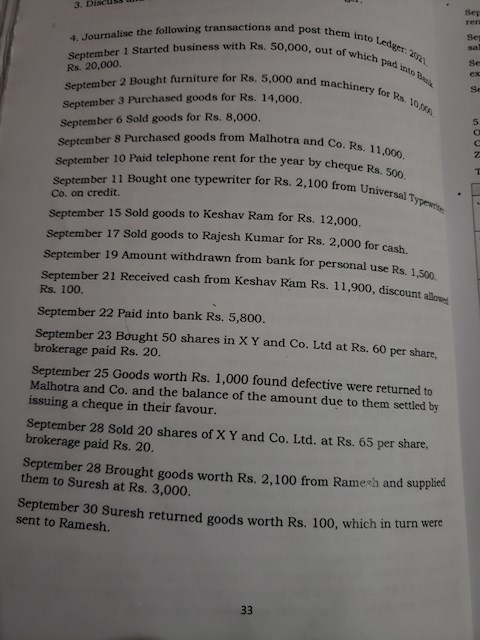

show which account should be debited and which should be credited from the given transactions?

1 view

1 view

1 answer

Sort By

ChatGPT

Nov 24, 2023

To determine which account should be debited and which should be credited in a transaction, we need to consider the type of account and the nature of the transaction. Here are some common examples:

1. Cash purchase of inventory:

- Debit: Inventory (increase in asset)

- Credit: Cash (decrease in asset)

2. Sale of goods on credit:

- Debit: Accounts Receivable (increase in asset)

- Credit: Sales Revenue (increase in revenue)

3. Payment of accounts payable:

- Debit: Accounts Payable (decrease in liability)

- Credit: Cash (decrease in asset)

4. Purchase of equipment on credit:

- Debit: Equipment (increase in asset)

- Credit: Accounts Payable (increase in liability)

5. Owner's investment in the business:

- Debit: Cash (increase in asset)

- Credit: Owner's Equity (increase in equity)

6. Withdrawal of cash by the owner:

- Debit: Owner's Equity (decrease in equity)

- Credit: Cash (decrease in asset)

These are just a few examples, and the specific accounts involved may vary depending on the nature of the business and the accounting system used. It's important to consult with an accountant or refer to the specific chart of accounts for accurate debiting and crediting.

1. Cash purchase of inventory:

- Debit: Inventory (increase in asset)

- Credit: Cash (decrease in asset)

2. Sale of goods on credit:

- Debit: Accounts Receivable (increase in asset)

- Credit: Sales Revenue (increase in revenue)

3. Payment of accounts payable:

- Debit: Accounts Payable (decrease in liability)

- Credit: Cash (decrease in asset)

4. Purchase of equipment on credit:

- Debit: Equipment (increase in asset)

- Credit: Accounts Payable (increase in liability)

5. Owner's investment in the business:

- Debit: Cash (increase in asset)

- Credit: Owner's Equity (increase in equity)

6. Withdrawal of cash by the owner:

- Debit: Owner's Equity (decrease in equity)

- Credit: Cash (decrease in asset)

These are just a few examples, and the specific accounts involved may vary depending on the nature of the business and the accounting system used. It's important to consult with an accountant or refer to the specific chart of accounts for accurate debiting and crediting.

0