Anonymous

Oct 19, 2024

1 view

1 view

2 answers

Sort By

ChatGPT

Oct 19, 2024

Manufacturing Account:

The manufacturing account is prepared by manufacturing companies to show the cost of goods produced during a specific period. It includes direct materials, direct labor, and manufacturing overhead costs. The manufacturing account helps in determining the cost of production and calculating the cost of goods sold.

Trading Account:

The trading account is prepared by trading companies to show the gross profit earned from buying and selling goods. It includes the cost of goods sold, opening stock, purchases, and closing stock. The trading account helps in calculating the gross profit earned by the company during a specific period.

Profit & Loss Account:

The profit and loss account is prepared by all types of businesses to show the net profit or loss earned during a specific period. It includes all revenues and expenses incurred by the company. The profit and loss account helps in determining the overall financial performance of the company and its profitability.

The manufacturing account is prepared by manufacturing companies to show the cost of goods produced during a specific period. It includes direct materials, direct labor, and manufacturing overhead costs. The manufacturing account helps in determining the cost of production and calculating the cost of goods sold.

Trading Account:

The trading account is prepared by trading companies to show the gross profit earned from buying and selling goods. It includes the cost of goods sold, opening stock, purchases, and closing stock. The trading account helps in calculating the gross profit earned by the company during a specific period.

Profit & Loss Account:

The profit and loss account is prepared by all types of businesses to show the net profit or loss earned during a specific period. It includes all revenues and expenses incurred by the company. The profit and loss account helps in determining the overall financial performance of the company and its profitability.

0

Google Gemini AI

Oct 19, 2024

Manufacturing Account

- Records the cost of goods manufactured during a period.

- Debited with:

- Direct materials used

- Direct labor

- Manufacturing overhead

- Credited with:

- Opening work-in-process inventory

- Closing work-in-process inventory

Trading Account

- Records the revenue from sales and the cost of goods sold during a period.

- Debited with:

- Opening finished goods inventory

- Purchases

- Direct expenses

- Credited with:

- Sales revenue

- Closing finished goods inventory

Profit & Loss Account (Income Statement)

- Summarizes the financial performance of a business for a period.

- Consists of:

- Revenue: Total income earned

- Expenses: Total costs incurred

- Profit (Loss): Net income (revenue minus expenses)

Relationship between Accounts

- The balance of the Manufacturing Account is transferred to the Trading Account as the cost of goods sold.

- The balance of the Trading Account is transferred to the Profit & Loss Account as the gross profit (revenue minus cost of goods sold).

- The gross profit is further reduced by operating expenses and other income/expenses to arrive at the net profit or loss.

Example

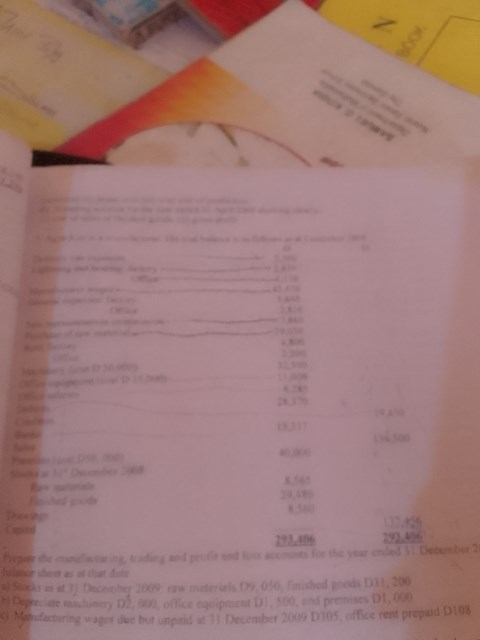

A manufacturing company has the following data for a period:

- Direct materials used: $50,000

- Direct labor: $75,000

- Manufacturing overhead: $30,000

- Sales revenue: $200,000

- Opening finished goods inventory: $25,000

- Closing finished goods inventory: $35,000

Manufacturing Account:

- Debit: $50,000 + $75,000 + $30,000 = $155,000

- Credit: $25,000 (opening WIP) + $35,000 (closing WIP) = $60,000

- Balance (cost of goods manufactured): $95,000

Trading Account:

- Debit: $25,000 (opening FG) + $95,000 (cost of goods manufactured) = $120,000

- Credit: $200,000 (sales revenue) + $35,000 (closing FG) = $235,000

- Balance (gross profit): $115,000

Profit & Loss Account:

- Revenue: $200,000

- Expenses: $120,000 (gross profit), $45,000 (operating expenses), $5,000 (other income)

- Profit: $20,000 (net profit)

- Records the cost of goods manufactured during a period.

- Debited with:

- Direct materials used

- Direct labor

- Manufacturing overhead

- Credited with:

- Opening work-in-process inventory

- Closing work-in-process inventory

Trading Account

- Records the revenue from sales and the cost of goods sold during a period.

- Debited with:

- Opening finished goods inventory

- Purchases

- Direct expenses

- Credited with:

- Sales revenue

- Closing finished goods inventory

Profit & Loss Account (Income Statement)

- Summarizes the financial performance of a business for a period.

- Consists of:

- Revenue: Total income earned

- Expenses: Total costs incurred

- Profit (Loss): Net income (revenue minus expenses)

Relationship between Accounts

- The balance of the Manufacturing Account is transferred to the Trading Account as the cost of goods sold.

- The balance of the Trading Account is transferred to the Profit & Loss Account as the gross profit (revenue minus cost of goods sold).

- The gross profit is further reduced by operating expenses and other income/expenses to arrive at the net profit or loss.

Example

A manufacturing company has the following data for a period:

- Direct materials used: $50,000

- Direct labor: $75,000

- Manufacturing overhead: $30,000

- Sales revenue: $200,000

- Opening finished goods inventory: $25,000

- Closing finished goods inventory: $35,000

Manufacturing Account:

- Debit: $50,000 + $75,000 + $30,000 = $155,000

- Credit: $25,000 (opening WIP) + $35,000 (closing WIP) = $60,000

- Balance (cost of goods manufactured): $95,000

Trading Account:

- Debit: $25,000 (opening FG) + $95,000 (cost of goods manufactured) = $120,000

- Credit: $200,000 (sales revenue) + $35,000 (closing FG) = $235,000

- Balance (gross profit): $115,000

Profit & Loss Account:

- Revenue: $200,000

- Expenses: $120,000 (gross profit), $45,000 (operating expenses), $5,000 (other income)

- Profit: $20,000 (net profit)

0