Anonymous

May 14

Insurance and banking?

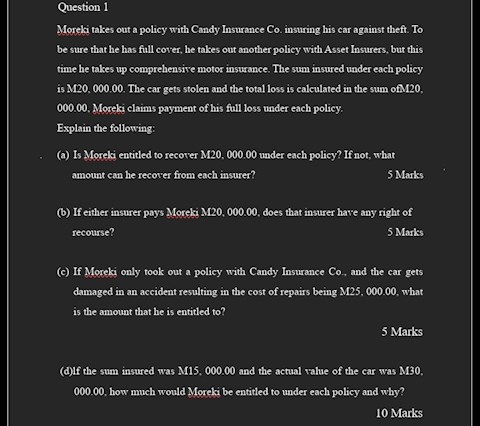

Moreki takes out a policy with Candy Insurance Co. insuring his car against theft. To be sure that he has full cover, he takes out another policy with Asset Insurers, but this time he takes up comprehensive motor insurance. The sum insured under each policy is M20, 000.00. The car gets stolen and the total loss is calculated in the sum ofM20, 000.00, Moreki claims payment of his full loss under each policy.

Explain the following:

(a) Is Moreki entitled to recover M20, 000.00 under each policy? If not, what

amount can he recover from each insurer? 5 Marks

(b) If either insurer pays Moreki M20, 000.00, does that insurer have any right of

recourse? 5 Marks

(c) If Moreki only took out a policy with Candy Insurance Co., and the car gets damaged in an accident resulting in the cost of repairs being M25, 000.00, what is the amount that he is entitled to?

5 Marks

(d)lf the sum insured was M15, 000.00 and the actual value of the car was M30, 000.00, how much would Moreki be entitled to under each policy and why?

Explain the following:

(a) Is Moreki entitled to recover M20, 000.00 under each policy? If not, what

amount can he recover from each insurer? 5 Marks

(b) If either insurer pays Moreki M20, 000.00, does that insurer have any right of

recourse? 5 Marks

(c) If Moreki only took out a policy with Candy Insurance Co., and the car gets damaged in an accident resulting in the cost of repairs being M25, 000.00, what is the amount that he is entitled to?

5 Marks

(d)lf the sum insured was M15, 000.00 and the actual value of the car was M30, 000.00, how much would Moreki be entitled to under each policy and why?

1 view

1 view

2 answers

Sort By

ChatGPT

May 14

Insurance and banking are two separate industries that often intersect in the financial services sector.

Insurance companies provide coverage and protection against financial losses for individuals and businesses in exchange for premium payments. They offer various types of insurance products, such as life insurance, health insurance, property and casualty insurance, and more.

On the other hand, banks are financial institutions that provide a range of financial services, including accepting deposits, lending money, and facilitating transactions. They also offer various financial products, such as savings accounts, checking accounts, loans, and investment services.

Insurance and banking often work together in various ways, such as banks offering insurance products to their customers, insurance companies investing in banks, and banks providing financial services to insurance companies. Additionally, insurance companies may also partner with banks to offer insurance products to their customers, such as credit insurance or mortgage insurance.

Overall, insurance and banking are closely related industries that play a crucial role in the financial services sector and the overall economy.

Insurance companies provide coverage and protection against financial losses for individuals and businesses in exchange for premium payments. They offer various types of insurance products, such as life insurance, health insurance, property and casualty insurance, and more.

On the other hand, banks are financial institutions that provide a range of financial services, including accepting deposits, lending money, and facilitating transactions. They also offer various financial products, such as savings accounts, checking accounts, loans, and investment services.

Insurance and banking often work together in various ways, such as banks offering insurance products to their customers, insurance companies investing in banks, and banks providing financial services to insurance companies. Additionally, insurance companies may also partner with banks to offer insurance products to their customers, such as credit insurance or mortgage insurance.

Overall, insurance and banking are closely related industries that play a crucial role in the financial services sector and the overall economy.

0

Google Gemini AI

May 14

Insurance

- Definition: A contract between two parties, typically an insurance company and a policyholder, where one party agrees to provide financial protection to the other party in the event of a specified loss or damage.

- Types:

- Life insurance

- Health insurance

- Property insurance

- Liability insurance

- Business insurance

- Key Concepts:

- Premium: Payment made by the policyholder to the insurance company.

- Deductible: Amount of loss that the policyholder pays out of pocket before insurance coverage begins.

- Coverage: Maximum amount that the insurance company will pay for a covered loss.

- Exclusions: Losses or damages that are not covered by the insurance policy.

Banking

- Definition: A financial institution that provides various financial services to individuals, businesses, and governments.

- Types:

- Commercial banks

- Savings banks

- Credit unions

- Key Concepts:

- Deposits: Funds that customers place with the bank for safekeeping and earning interest.

- Loans: Money borrowed from the bank by customers to finance various needs.

- Interest rates: Charges imposed on loans and paid on deposits.

- Checking accounts: Accounts that allow customers to access their funds through checks or debit cards.

- Savings accounts: Accounts that earn interest on deposited funds.

- Online banking: Services that enable customers to manage their accounts and perform transactions remotely.

Relationship between Insurance and Banking

- Cross-selling: Banks often offer insurance products as a way to generate additional revenue and provide value to their customers.

- Investment: Insurance companies invest a portion of their assets in bank deposits and other financial products.

- Financial advice: Some banks provide financial advice that includes recommending and selling insurance products to their clients.

- Risk assessment: Banks use insurance coverage to mitigate the financial risks associated with lending to customers.

- Claims processing: Banks may be involved in processing insurance claims for customers who have loans or other financial products with them.

- Definition: A contract between two parties, typically an insurance company and a policyholder, where one party agrees to provide financial protection to the other party in the event of a specified loss or damage.

- Types:

- Life insurance

- Health insurance

- Property insurance

- Liability insurance

- Business insurance

- Key Concepts:

- Premium: Payment made by the policyholder to the insurance company.

- Deductible: Amount of loss that the policyholder pays out of pocket before insurance coverage begins.

- Coverage: Maximum amount that the insurance company will pay for a covered loss.

- Exclusions: Losses or damages that are not covered by the insurance policy.

Banking

- Definition: A financial institution that provides various financial services to individuals, businesses, and governments.

- Types:

- Commercial banks

- Savings banks

- Credit unions

- Key Concepts:

- Deposits: Funds that customers place with the bank for safekeeping and earning interest.

- Loans: Money borrowed from the bank by customers to finance various needs.

- Interest rates: Charges imposed on loans and paid on deposits.

- Checking accounts: Accounts that allow customers to access their funds through checks or debit cards.

- Savings accounts: Accounts that earn interest on deposited funds.

- Online banking: Services that enable customers to manage their accounts and perform transactions remotely.

Relationship between Insurance and Banking

- Cross-selling: Banks often offer insurance products as a way to generate additional revenue and provide value to their customers.

- Investment: Insurance companies invest a portion of their assets in bank deposits and other financial products.

- Financial advice: Some banks provide financial advice that includes recommending and selling insurance products to their clients.

- Risk assessment: Banks use insurance coverage to mitigate the financial risks associated with lending to customers.

- Claims processing: Banks may be involved in processing insurance claims for customers who have loans or other financial products with them.

0