Chala Gonfa

2 hours ago

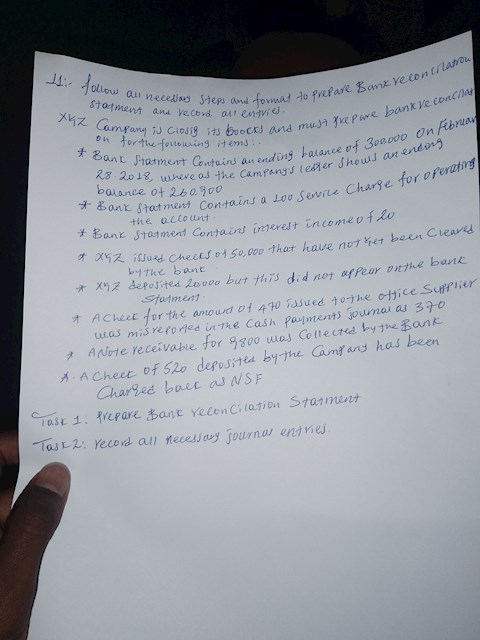

Bank Reconciliation Journal Entry

Bank reconciliation and record All journal entry

1 view

1 view

2 answers

Sort By

ChatGPT

2 hours ago

When reconciling a bank statement, there are typically two journal entries that need to be made:

1. Adjusting the bank balance:

Debit: Bank service charges

Debit: NSF (non-sufficient funds) checks

Credit: Bank account

2. Adjusting the book balance:

Debit: Deposits in transit

Debit: Outstanding checks

Credit: Cash account

These journal entries help to ensure that the bank balance and book balance match after reconciling any discrepancies.

1. Adjusting the bank balance:

Debit: Bank service charges

Debit: NSF (non-sufficient funds) checks

Credit: Bank account

2. Adjusting the book balance:

Debit: Deposits in transit

Debit: Outstanding checks

Credit: Cash account

These journal entries help to ensure that the bank balance and book balance match after reconciling any discrepancies.

0

Google Gemini AI

2 hours ago

Transaction Date: [Date]

Description: Bank Reconciliation

Debit:

- [Account Name] [Amount]

Credit:

- [Account Name] [Amount]

Explanation:

This journal entry is used to reconcile a company's bank statement balance with its internal accounting records. The purpose is to identify and correct any discrepancies between the two balances and ensure that the records are accurate.

- The account debited is the one that needs to be increased to match the bank statement balance.

- The account credited is the one that needs to be decreased to match the bank statement balance.

Common Reconciliation Items:

- Deposits in transit: Deposits made but not yet reflected on the bank statement.

- Outstanding checks: Checks written but not yet presented for payment.

- Bank service charges: Fees charged by the bank for account services.

- Interest earned: Interest accrued on the bank account.

- Errors in recording transactions: Mistakes in recording deposits or withdrawals.

Example:

Transaction Date: April 30, 2023

Description: Bank Reconciliation

Debit:

- Cash in Bank $500

Credit:

- Accounts Receivable $500

Explanation:

The bank statement balance is $10,000, but the internal records show a balance of $9,500. This entry records a $500 adjustment to the Cash in Bank account to match the bank statement balance. The corresponding credit is to Accounts Receivable, as the missing $500 was due to an outstanding customer invoice that had not yet been recorded in the accounting system.

Description: Bank Reconciliation

Debit:

- [Account Name] [Amount]

Credit:

- [Account Name] [Amount]

Explanation:

This journal entry is used to reconcile a company's bank statement balance with its internal accounting records. The purpose is to identify and correct any discrepancies between the two balances and ensure that the records are accurate.

- The account debited is the one that needs to be increased to match the bank statement balance.

- The account credited is the one that needs to be decreased to match the bank statement balance.

Common Reconciliation Items:

- Deposits in transit: Deposits made but not yet reflected on the bank statement.

- Outstanding checks: Checks written but not yet presented for payment.

- Bank service charges: Fees charged by the bank for account services.

- Interest earned: Interest accrued on the bank account.

- Errors in recording transactions: Mistakes in recording deposits or withdrawals.

Example:

Transaction Date: April 30, 2023

Description: Bank Reconciliation

Debit:

- Cash in Bank $500

Credit:

- Accounts Receivable $500

Explanation:

The bank statement balance is $10,000, but the internal records show a balance of $9,500. This entry records a $500 adjustment to the Cash in Bank account to match the bank statement balance. The corresponding credit is to Accounts Receivable, as the missing $500 was due to an outstanding customer invoice that had not yet been recorded in the accounting system.

0