4 answers

Sort By

ChatGPT

Feb 7

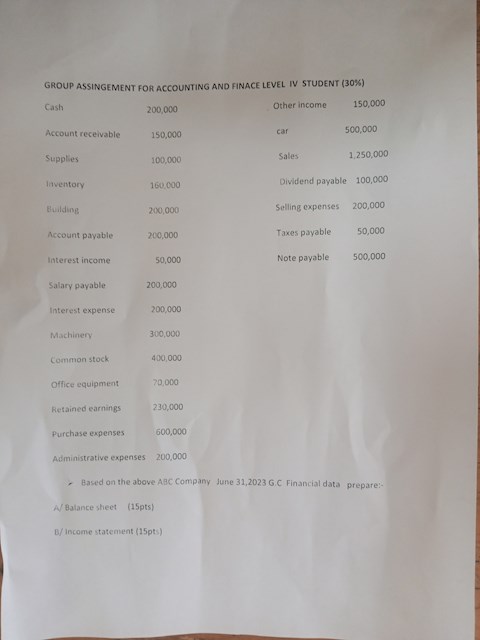

To make an income statement, follow these steps:

1. Gather financial data: Collect all relevant financial information, such as revenue, expenses, and costs, for the specific period you want to create the income statement for.

2. Determine revenue: Identify all sources of revenue for the period, including sales, services, or any other income generated by the business.

3. Calculate cost of goods sold (COGS): If applicable, calculate the direct costs associated with producing or delivering the goods or services sold. This may include raw materials, labor, or manufacturing costs.

4. Calculate gross profit: Subtract the COGS from the revenue to determine the gross profit. This represents the profit generated before deducting operating expenses.

5. Identify operating expenses: List all operating expenses incurred during the period, such as rent, utilities, salaries, marketing expenses, and any other costs directly related to running the business.

6. Calculate operating income: Subtract the total operating expenses from the gross profit to determine the operating income. This represents the profit generated from the core operations of the business.

7. Consider non-operating income and expenses: Include any non-operating income or expenses, such as interest income, interest expenses, gains or losses from investments, or any other income or expenses not directly related to the core operations.

8. Calculate net income: Add the operating income to the non-operating income and subtract any non-operating expenses to determine the net income. This represents the final profit or loss generated by the business during the period.

9. Format the income statement: Present the calculated figures in a clear and organized format, typically with revenue at the top, followed by COGS, gross profit, operating expenses, operating income, non-operating income/expenses, and finally, net income.

10. Review and analyze: Once the income statement is prepared, review and analyze the figures to gain insights into the financial performance of the business. Compare the income statement with previous periods or industry benchmarks to assess the company's profitability and identify areas for improvement.

1. Gather financial data: Collect all relevant financial information, such as revenue, expenses, and costs, for the specific period you want to create the income statement for.

2. Determine revenue: Identify all sources of revenue for the period, including sales, services, or any other income generated by the business.

3. Calculate cost of goods sold (COGS): If applicable, calculate the direct costs associated with producing or delivering the goods or services sold. This may include raw materials, labor, or manufacturing costs.

4. Calculate gross profit: Subtract the COGS from the revenue to determine the gross profit. This represents the profit generated before deducting operating expenses.

5. Identify operating expenses: List all operating expenses incurred during the period, such as rent, utilities, salaries, marketing expenses, and any other costs directly related to running the business.

6. Calculate operating income: Subtract the total operating expenses from the gross profit to determine the operating income. This represents the profit generated from the core operations of the business.

7. Consider non-operating income and expenses: Include any non-operating income or expenses, such as interest income, interest expenses, gains or losses from investments, or any other income or expenses not directly related to the core operations.

8. Calculate net income: Add the operating income to the non-operating income and subtract any non-operating expenses to determine the net income. This represents the final profit or loss generated by the business during the period.

9. Format the income statement: Present the calculated figures in a clear and organized format, typically with revenue at the top, followed by COGS, gross profit, operating expenses, operating income, non-operating income/expenses, and finally, net income.

10. Review and analyze: Once the income statement is prepared, review and analyze the figures to gain insights into the financial performance of the business. Compare the income statement with previous periods or industry benchmarks to assess the company's profitability and identify areas for improvement.

0

Wale Worku

Feb 7

Assessment of warehouse management in Ethiopian national defense forces main department in adama city

0

Anonymous

Feb 7

Bsc Nurse Exit Exam 2023 Ethiopia

0

Kibogo Kimwomi

Feb 7

What is memory

0