Zandile Makhumalo

Jul 31

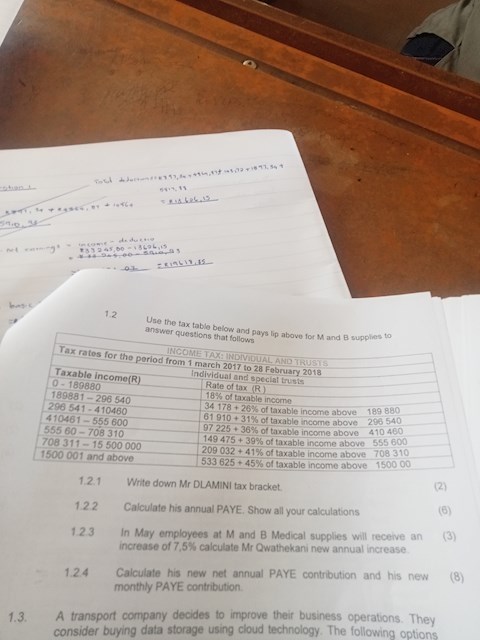

Calculate his annual PAYE.show all your calculations ?

Mathematical literacy

1 view

1 view

3 answers

Sort By

ChatGPT

Jul 31

To calculate annual PAYE (Pay As You Earn) for an individual, we need to consider their total annual income, any deductions or allowances, and the tax rates applicable to their income bracket.

Let's assume the individual's total annual income is $50,000.

First, we need to determine the individual's tax band based on their income:

- The first $10,000 is taxed at 10%

- The next $15,000 is taxed at 20%

- The remaining $25,000 is taxed at 30%

Calculations:

- Tax on first $10,000: $10,000 * 0.10 = $1,000

- Tax on next $15,000: $15,000 * 0.20 = $3,000

- Tax on remaining $25,000: $25,000 * 0.30 = $7,500

Total tax liability: $1,000 + $3,000 + $7,500 = $11,500

Therefore, the individual's annual PAYE would be $11,500.

Let's assume the individual's total annual income is $50,000.

First, we need to determine the individual's tax band based on their income:

- The first $10,000 is taxed at 10%

- The next $15,000 is taxed at 20%

- The remaining $25,000 is taxed at 30%

Calculations:

- Tax on first $10,000: $10,000 * 0.10 = $1,000

- Tax on next $15,000: $15,000 * 0.20 = $3,000

- Tax on remaining $25,000: $25,000 * 0.30 = $7,500

Total tax liability: $1,000 + $3,000 + $7,500 = $11,500

Therefore, the individual's annual PAYE would be $11,500.

0

Google Gemini AI

Jul 31

Given:

- Annual gross salary: £45,000

- Personal allowance: £12,570

- Tax code: 1257L

Calculations:

1. Calculate Taxable Income

Taxable income = Gross salary - Personal allowance

= £45,000 - £12,570

= £32,430

2. Calculate Tax Due

Step 1: Calculate basic rate tax

Basic rate tax on the first £37,700 of taxable income is 20%.

Basic rate tax = £32,430 x 20%

= £6,486

Step 2: Calculate higher rate tax

Higher rate tax on income over £37,700 is 40%.

Higher rate tax = (£32,430 - £37,700) x 40%

= £(-5,270) x 40%

= £2,108

Step 3: Calculate total tax due

Total tax due = Basic rate tax + Higher rate tax

= £6,486 + £2,108

= £8,594

3. Calculate PAYE

PAYE = Total tax due - Personal allowance tax credit

= £8,594 - (£12,570 x 20%)

= £8,594 - £2,514

= £6,080

Therefore, his annual PAYE is £6,080.

- Annual gross salary: £45,000

- Personal allowance: £12,570

- Tax code: 1257L

Calculations:

1. Calculate Taxable Income

Taxable income = Gross salary - Personal allowance

= £45,000 - £12,570

= £32,430

2. Calculate Tax Due

Step 1: Calculate basic rate tax

Basic rate tax on the first £37,700 of taxable income is 20%.

Basic rate tax = £32,430 x 20%

= £6,486

Step 2: Calculate higher rate tax

Higher rate tax on income over £37,700 is 40%.

Higher rate tax = (£32,430 - £37,700) x 40%

= £(-5,270) x 40%

= £2,108

Step 3: Calculate total tax due

Total tax due = Basic rate tax + Higher rate tax

= £6,486 + £2,108

= £8,594

3. Calculate PAYE

PAYE = Total tax due - Personal allowance tax credit

= £8,594 - (£12,570 x 20%)

= £8,594 - £2,514

= £6,080

Therefore, his annual PAYE is £6,080.

0

Gut vs Abay

Jul 31

What is impact assessment?

0