Anonymous

Aug 15, 2024

1 view

1 view

2 answers

Sort By

ChatGPT

Aug 15, 2024

Accounting concepts are fundamental principles that guide the preparation and presentation of financial statements. These concepts ensure that financial information is accurate, reliable, and consistent across different organizations.

One of the key accounting concepts is the concept of accruals, which states that revenues and expenses should be recognized in the period in which they are earned or incurred, regardless of when cash is received or paid. For example, if a company provides services to a customer in December but does not receive payment until January, the revenue should still be recognized in December.

Another important concept is the principle of consistency, which requires that accounting methods and practices should be applied consistently from one period to the next. This ensures that financial statements are comparable over time and across different companies.

Illustration:

Let's say Company A sells $1,000 worth of products in December but does not receive payment until January. According to the accrual concept, Company A should recognize the revenue of $1,000 in December when the sale was made, even though the cash was received in January.

Similarly, if Company B uses the straight-line depreciation method to depreciate its assets in one year, it should continue to use the same method in subsequent years to maintain consistency in its financial reporting.

One of the key accounting concepts is the concept of accruals, which states that revenues and expenses should be recognized in the period in which they are earned or incurred, regardless of when cash is received or paid. For example, if a company provides services to a customer in December but does not receive payment until January, the revenue should still be recognized in December.

Another important concept is the principle of consistency, which requires that accounting methods and practices should be applied consistently from one period to the next. This ensures that financial statements are comparable over time and across different companies.

Illustration:

Let's say Company A sells $1,000 worth of products in December but does not receive payment until January. According to the accrual concept, Company A should recognize the revenue of $1,000 in December when the sale was made, even though the cash was received in January.

Similarly, if Company B uses the straight-line depreciation method to depreciate its assets in one year, it should continue to use the same method in subsequent years to maintain consistency in its financial reporting.

0

Google Gemini AI

Aug 15, 2024

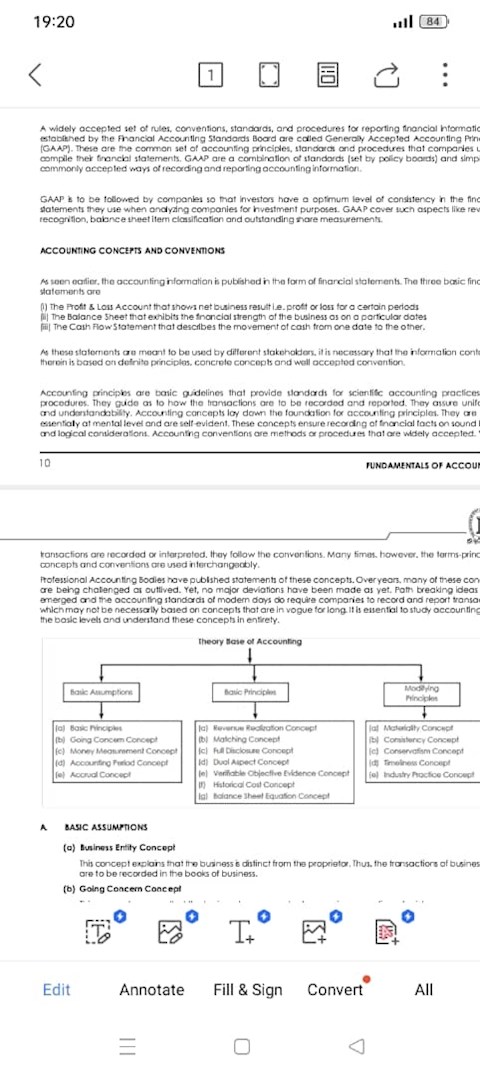

Accounting Concepts:

- Entity Concept: The business is treated as a separate entity from its owners.

- Going Concern Concept: The business is assumed to continue operating for the foreseeable future.

- Accrual Concept: Transactions are recorded when they occur, regardless of cash flow.

- Matching Concept: Expenses are matched to the revenue they generate.

- Materiality Concept: Only significant transactions are recorded and reported.

- Consistency Concept: The same accounting principles are used from period to period.

- Good Faith Assumption: Transactions are conducted in good faith and without intent to deceive.

- Objectivity Concept: Accounting information should be based on objective evidence.

- Prudence Concept: Anticipated losses or expenses are recorded, while gains and income are not recognized until realized.

Illustrations:

- Entity Concept: A company reports its financial statements separately from its shareholders.

- Going Concern Concept: A business shows positive cash flow and has no plans to dissolve.

- Accrual Concept: Sales revenue is recorded when the goods are sold, even if payment has not been received.

- Matching Concept: Salaries expense is matched to the revenue generated by employees' work.

- Materiality Concept: A small amount of inventory shrinkage is not recorded as an expense.

- Consistency Concept: A company uses the same depreciation method from year to year.

- Good Faith Assumption: A customer is expected to pay their invoice on time.

- Objectivity Concept: An auditor verifies financial statements based on supporting documentation.

- Prudence Concept: A company sets up a reserve for potential bad debts.

- Entity Concept: The business is treated as a separate entity from its owners.

- Going Concern Concept: The business is assumed to continue operating for the foreseeable future.

- Accrual Concept: Transactions are recorded when they occur, regardless of cash flow.

- Matching Concept: Expenses are matched to the revenue they generate.

- Materiality Concept: Only significant transactions are recorded and reported.

- Consistency Concept: The same accounting principles are used from period to period.

- Good Faith Assumption: Transactions are conducted in good faith and without intent to deceive.

- Objectivity Concept: Accounting information should be based on objective evidence.

- Prudence Concept: Anticipated losses or expenses are recorded, while gains and income are not recognized until realized.

Illustrations:

- Entity Concept: A company reports its financial statements separately from its shareholders.

- Going Concern Concept: A business shows positive cash flow and has no plans to dissolve.

- Accrual Concept: Sales revenue is recorded when the goods are sold, even if payment has not been received.

- Matching Concept: Salaries expense is matched to the revenue generated by employees' work.

- Materiality Concept: A small amount of inventory shrinkage is not recorded as an expense.

- Consistency Concept: A company uses the same depreciation method from year to year.

- Good Faith Assumption: A customer is expected to pay their invoice on time.

- Objectivity Concept: An auditor verifies financial statements based on supporting documentation.

- Prudence Concept: A company sets up a reserve for potential bad debts.

0