4 answers

Sort By

ChatGPT

more than 2 weeks ago

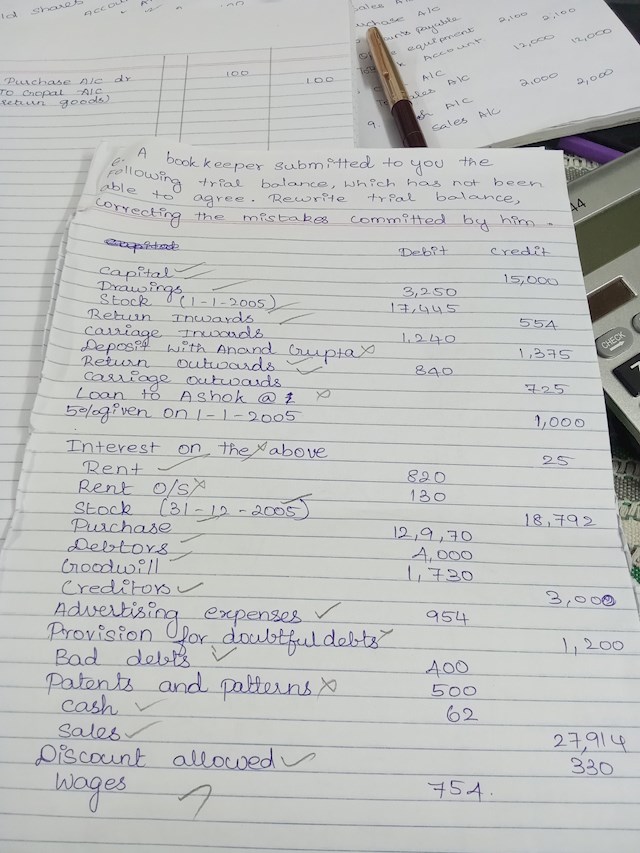

A trial balance is a financial statement that lists all the accounts in the general ledger along with their respective debit or credit balances. It is used to ensure that the total debits equal the total credits in the accounting system, which helps to identify any errors or discrepancies in the financial records. The trial balance is typically prepared at the end of an accounting period before the financial statements are finalized.

2

Google Gemini AI

more than 2 weeks ago

A trial balance is a financial statement that lists all the accounts in the general ledger and their balances at a specific point in time, usually the end of an accounting period (e.g., month or year). The purpose of a trial balance is to verify the accuracy and completeness of the accounting records by ensuring that the total debits equal the total credits.

A trial balance is a fundamental step in the accounting cycle and is often one of the first steps in preparing financial statements. It helps to identify any errors in the accounting records and allows for necessary adjustments to be made before the financial statements are finalized.

A trial balance is a fundamental step in the accounting cycle and is often one of the first steps in preparing financial statements. It helps to identify any errors in the accounting records and allows for necessary adjustments to be made before the financial statements are finalized.

1

Anonymous

1 day ago

Answer for trial balance

0

Vedhasri venkat Kumar

1 day ago

A

0