Anonymous

Dec 15, 2023

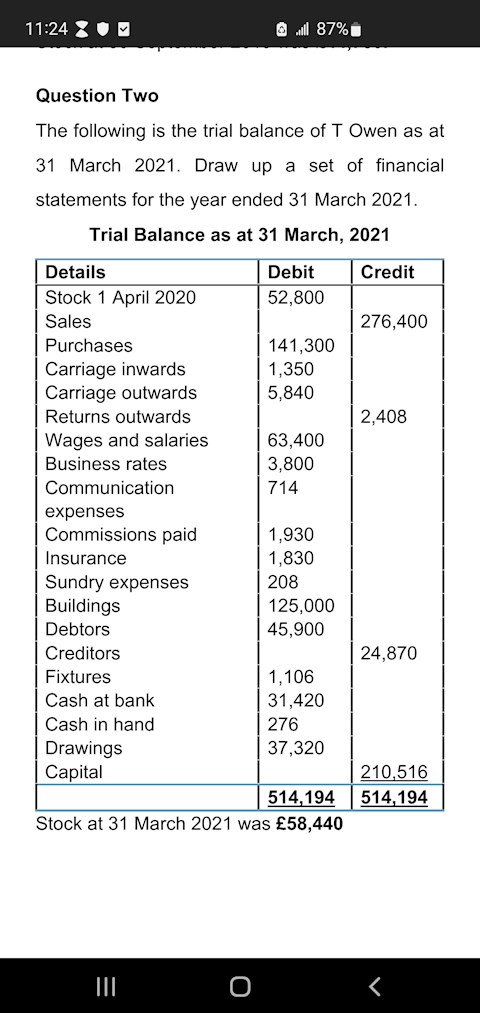

Prepare the financial position statement?

1 view

1 view

1 answer

Sort By

ChatGPT

Dec 15, 2023

To prepare a financial position statement, you will need the following information:

1. Assets: List all the assets owned by the company, including cash, accounts receivable, inventory, property, plant, and equipment, investments, and any other assets.

2. Liabilities: Include all the company's liabilities, such as accounts payable, loans, mortgages, accrued expenses, and any other outstanding debts.

3. Equity: Calculate the equity by subtracting the total liabilities from the total assets. This represents the net worth of the company.

4. Net Income: Determine the net income by subtracting all expenses from the total revenue earned during a specific period. This can be found in the income statement.

5. Retained Earnings: Include the retained earnings, which are the accumulated profits or losses that have not been distributed to shareholders as dividends.

Once you have gathered this information, you can prepare the financial position statement by organizing it into the following format:

[Company Name]

Financial Position Statement

[Date]

Assets:

- Cash: [Amount]

- Accounts Receivable: [Amount]

- Inventory: [Amount]

- Property, Plant, and Equipment: [Amount]

- Investments: [Amount]

- Other Assets: [Amount]

Total Assets: [Amount]

Liabilities:

- Accounts Payable: [Amount]

- Loans: [Amount]

- Mortgages: [Amount]

- Accrued Expenses: [Amount]

- Other Liabilities: [Amount]

Total Liabilities: [Amount]

Equity:

- Share Capital: [Amount]

- Retained Earnings: [Amount]

Total Equity: [Amount]

Net Income: [Amount]

Once you have filled in the amounts for each category, calculate the total assets, total liabilities, and total equity. Ensure that the equation Assets = Liabilities + Equity holds true.

1. Assets: List all the assets owned by the company, including cash, accounts receivable, inventory, property, plant, and equipment, investments, and any other assets.

2. Liabilities: Include all the company's liabilities, such as accounts payable, loans, mortgages, accrued expenses, and any other outstanding debts.

3. Equity: Calculate the equity by subtracting the total liabilities from the total assets. This represents the net worth of the company.

4. Net Income: Determine the net income by subtracting all expenses from the total revenue earned during a specific period. This can be found in the income statement.

5. Retained Earnings: Include the retained earnings, which are the accumulated profits or losses that have not been distributed to shareholders as dividends.

Once you have gathered this information, you can prepare the financial position statement by organizing it into the following format:

[Company Name]

Financial Position Statement

[Date]

Assets:

- Cash: [Amount]

- Accounts Receivable: [Amount]

- Inventory: [Amount]

- Property, Plant, and Equipment: [Amount]

- Investments: [Amount]

- Other Assets: [Amount]

Total Assets: [Amount]

Liabilities:

- Accounts Payable: [Amount]

- Loans: [Amount]

- Mortgages: [Amount]

- Accrued Expenses: [Amount]

- Other Liabilities: [Amount]

Total Liabilities: [Amount]

Equity:

- Share Capital: [Amount]

- Retained Earnings: [Amount]

Total Equity: [Amount]

Net Income: [Amount]

Once you have filled in the amounts for each category, calculate the total assets, total liabilities, and total equity. Ensure that the equation Assets = Liabilities + Equity holds true.

0