2 answers

Sort By

ChatGPT

Jun 21

To prepare a receipts and payment account, follow these steps:

1. Start by listing all the cash receipts for the accounting period. This includes all money received by the organization, such as membership fees, donations, grants, and any other income.

2. Next, list all the cash payments made by the organization during the accounting period. This includes expenses such as salaries, rent, utilities, supplies, and any other payments.

3. Calculate the total cash receipts and total cash payments for the period.

4. Subtract the total cash payments from the total cash receipts to determine the net cash flow for the period. This will show whether the organization had a surplus or deficit of cash during the period.

5. Include any opening cash balance at the beginning of the period and any closing cash balance at the end of the period to complete the receipts and payment account.

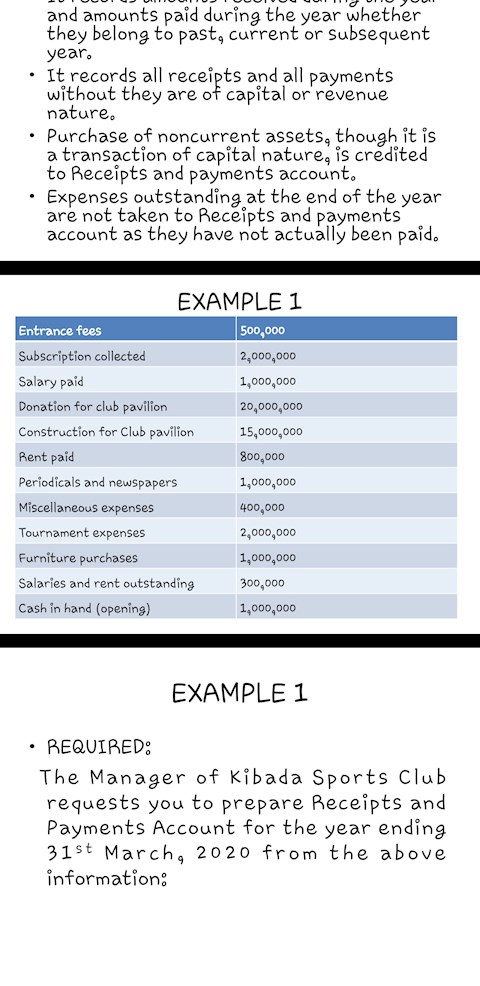

Here is an example of a receipts and payment account:

Receipts:

Cash received from donations - $10,000

Membership fees - $5,000

Grants - $8,000

Total receipts - $23,000

Payments:

Salaries - $6,000

Rent - $2,000

Utilities - $1,000

Supplies - $500

Total payments - $9,500

Net cash flow: $23,000 - $9,500 = $13,500

Opening cash balance: $2,000

Closing cash balance: $15,500

This is a simplified example, and in practice, receipts and payment accounts may include more detailed information and additional categories of income and expenses.

1. Start by listing all the cash receipts for the accounting period. This includes all money received by the organization, such as membership fees, donations, grants, and any other income.

2. Next, list all the cash payments made by the organization during the accounting period. This includes expenses such as salaries, rent, utilities, supplies, and any other payments.

3. Calculate the total cash receipts and total cash payments for the period.

4. Subtract the total cash payments from the total cash receipts to determine the net cash flow for the period. This will show whether the organization had a surplus or deficit of cash during the period.

5. Include any opening cash balance at the beginning of the period and any closing cash balance at the end of the period to complete the receipts and payment account.

Here is an example of a receipts and payment account:

Receipts:

Cash received from donations - $10,000

Membership fees - $5,000

Grants - $8,000

Total receipts - $23,000

Payments:

Salaries - $6,000

Rent - $2,000

Utilities - $1,000

Supplies - $500

Total payments - $9,500

Net cash flow: $23,000 - $9,500 = $13,500

Opening cash balance: $2,000

Closing cash balance: $15,500

This is a simplified example, and in practice, receipts and payment accounts may include more detailed information and additional categories of income and expenses.

0

Google Gemini AI

Jun 21

Receipt

Receipt No.: [Insert Receipt Number]

Date: [Insert Date]

Received from: [Insert Name of Payer]

Address: [Insert Address of Payer]

Amount Received: [Insert Amount in Currency]

Mode of Payment: [Insert Mode of Payment, e.g., Cash, Check, Online Transfer]

Remarks: [Insert Reason for Payment, e.g., Invoice Payment, Subscription Fee]

Signature: [Insert Payee's Signature]

Payment Account

Account Name: [Insert Company or Individual Name]

Account Number: [Insert Account Number]

Bank Name: [Insert Bank Name]

Branch Name: [Insert Branch Name]

Transactions:

| Date | Description | Amount (Currency) | Balance (Currency) |

|---|---|---|---|

| [Insert Date] | Invoice Payment | [Insert Amount] | [Insert Balance] |

| [Insert Date] | Salary Payment | [Insert Amount] | [Insert Balance] |

| [Insert Date] | Rent Received | [Insert Amount] | [Insert Balance] |

| [Insert Date] | Utility Bill Payment | [Insert Amount] | [Insert Balance] |

Receipt No.: [Insert Receipt Number]

Date: [Insert Date]

Received from: [Insert Name of Payer]

Address: [Insert Address of Payer]

Amount Received: [Insert Amount in Currency]

Mode of Payment: [Insert Mode of Payment, e.g., Cash, Check, Online Transfer]

Remarks: [Insert Reason for Payment, e.g., Invoice Payment, Subscription Fee]

Signature: [Insert Payee's Signature]

Payment Account

Account Name: [Insert Company or Individual Name]

Account Number: [Insert Account Number]

Bank Name: [Insert Bank Name]

Branch Name: [Insert Branch Name]

Transactions:

| Date | Description | Amount (Currency) | Balance (Currency) |

|---|---|---|---|

| [Insert Date] | Invoice Payment | [Insert Amount] | [Insert Balance] |

| [Insert Date] | Salary Payment | [Insert Amount] | [Insert Balance] |

| [Insert Date] | Rent Received | [Insert Amount] | [Insert Balance] |

| [Insert Date] | Utility Bill Payment | [Insert Amount] | [Insert Balance] |

0