2 answers

Sort By

ChatGPT

Oct 6

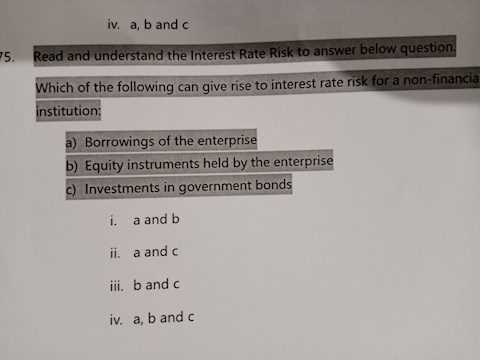

Interest rate risk is the risk that changes in interest rates will have a negative impact on the value of an investment or a financial institution's profitability. This risk is particularly relevant for fixed-income securities, such as bonds, as their value is inversely related to interest rates. When interest rates rise, the value of existing bonds decreases, and vice versa. Financial institutions, such as banks, are also exposed to interest rate risk as they borrow and lend money at different interest rates. Managing interest rate risk is important for investors and financial institutions to protect their portfolios and profitability. Strategies to mitigate interest rate risk include diversification, using derivatives, and adjusting the duration of fixed-income securities.

0

Google Gemini AI

Oct 6

Interest Rate Risk

Interest rate risk refers to the potential financial losses or gains that can arise from changes in interest rates. It is a critical risk that financial institutions, companies, and investors face.

Types of Interest Rate Risk:

- Reinvestment Risk: The risk that future cash flows from investments will be reinvested at lower interest rates, resulting in lower returns.

- Extension Risk: The risk that the maturity of assets and liabilities becomes mismatched, leading to potential losses if interest rates rise.

- Price Risk: The risk that the value of financial instruments, such as bonds, will decline in response to interest rate increases.

Causes of Interest Rate Risk:

- Changes in central bank policy

- Economic conditions (e.g., inflation, growth)

- Market sentiment

Consequences of Interest Rate Risk:

- Reduced profitability for businesses

- Losses on investments

- Increased borrowing costs

- Financial instability

Management of Interest Rate Risk:

- Asset-Liability Management (ALM): Matching the maturity and cash flows of assets and liabilities to minimize the impact of interest rate changes.

- Hedging Instruments: Using derivatives, such as interest rate swaps or options, to mitigate risk.

- Active Portfolio Management: Adjusting portfolio allocations and durations to manage exposure to interest rate changes.

- Interest Rate Models: Forecasting and analyzing potential interest rate scenarios to inform decision-making.

Risk Assessment and Measurement:

- Duration: A measure of the sensitivity of an asset or liability's value to changes in interest rates.

- Value at Risk (VaR): A statistical measure of the maximum potential loss over a given time horizon at a specified confidence level.

- Stress Testing: Simulating extreme interest rate scenarios to assess the impact on financial positions.

Mitigation Strategies:

- Diversifying investments across different asset classes and maturities

- Investing in instruments with embedded interest rate protection

- Reducing leverage

- Implementing robust risk management policies and procedures

Interest rate risk refers to the potential financial losses or gains that can arise from changes in interest rates. It is a critical risk that financial institutions, companies, and investors face.

Types of Interest Rate Risk:

- Reinvestment Risk: The risk that future cash flows from investments will be reinvested at lower interest rates, resulting in lower returns.

- Extension Risk: The risk that the maturity of assets and liabilities becomes mismatched, leading to potential losses if interest rates rise.

- Price Risk: The risk that the value of financial instruments, such as bonds, will decline in response to interest rate increases.

Causes of Interest Rate Risk:

- Changes in central bank policy

- Economic conditions (e.g., inflation, growth)

- Market sentiment

Consequences of Interest Rate Risk:

- Reduced profitability for businesses

- Losses on investments

- Increased borrowing costs

- Financial instability

Management of Interest Rate Risk:

- Asset-Liability Management (ALM): Matching the maturity and cash flows of assets and liabilities to minimize the impact of interest rate changes.

- Hedging Instruments: Using derivatives, such as interest rate swaps or options, to mitigate risk.

- Active Portfolio Management: Adjusting portfolio allocations and durations to manage exposure to interest rate changes.

- Interest Rate Models: Forecasting and analyzing potential interest rate scenarios to inform decision-making.

Risk Assessment and Measurement:

- Duration: A measure of the sensitivity of an asset or liability's value to changes in interest rates.

- Value at Risk (VaR): A statistical measure of the maximum potential loss over a given time horizon at a specified confidence level.

- Stress Testing: Simulating extreme interest rate scenarios to assess the impact on financial positions.

Mitigation Strategies:

- Diversifying investments across different asset classes and maturities

- Investing in instruments with embedded interest rate protection

- Reducing leverage

- Implementing robust risk management policies and procedures

0